DEI: Celebrating Our Heritages

TFCU is committed to building a culture that emphasizes and celebrates diversity. In 2021, TFCU added the Diversity, Equity and Inclusion (DEI) Department to better

Tinker Federal Credit Union exists to help our members achieve their goals and realize their dreams.

2021 was a year of unique challenges. The economy faced supply chain issues and unprecedented increases in the cost of construction. There were stimulus payments from the government and earned child tax credit payments, then the payments were gone. We had a microchip shortage that wiped out the new car inventory, and, now in 2022, we have unprecedented high gas prices at the pumps. For our communities, we continued to see the impact of COVID-19 with businesses closing and on-again-off-again reactions to masks in public settings. In some areas of the credit union, the “war on talent” had TFCU losing employees faster than we could replace them. But not all of 2021 was bad.

TFCU remains financially sound, and our commitment to our membership is as strong as ever. In 2021, TFCU continued to process and approve Paycheck Protection Program loans. Since 2020, we funded over $22 million of these loans. We now serve over 430,000 members in the state of Oklahoma and beyond with over 200,000 personal loans and almost 700 business loans. We are working with our technology providers to expand electronic services while remaining diligent with data security. We will be opening our next branch in Norman in 2022 and will be expanding access to commercial and business services by year end.

While we celebrate the successes of those who came before us, we now welcome a new management team that is ready and eager to build an even stronger TFCU for tomorrow.

We have a great deal to accomplish if we want to build better access to your account information and to expand services, while protecting member data. To ensure we are providing the best in-person services, we aim to become an employer of choice to reduce turnover and ensure consistency in services. We are also preparing for new regulatory requirements in accounting beginning in 2023, and we must prepare for additional regulatory burden in the next few years as we continue to grow. Rest assured, your credit union is working to ensure that we are able to provide you with all the products and services you need now and well into the future.

On behalf of the entire staff, thank you for choosing TFCU. We are grateful for your loyalty and your confidence in us to reach these goals together. We look forward to taking care of you and your family in 2022.

Dave Willis

President & CEO

Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore.

Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. Ut wisi enim ad minim veniam, quis nostrud exerci tation ullamcorper suscipit lobortis nisl ut aliquip ex ea commodo consequat. Duis autem vel eum iriure dolor in hendrerit in vulputate velit esse molestie consequat, vel illum dolore eu feugiat nulla facilisis at vero eros et accumsan et iusto odio dignissim qui blandit praesent luptatum zzril delenit augue duis dolore te feugait.

Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. Ut wisi enim ad minim veniam, quis nostrud exerci tation ullamcorper suscipit lobortis nisl ut aliquip ex ea commodo consequat. Duis autem vel eum iriure dolor in hendrerit in vulputate velit esse molestie consequat, vel illum dolore eu feugiat nulla facilisis at vero eros et accumsan et iusto odio dignissim qui blandit praesent luptatum zzril delenit augue duis dolore te feugait.

TFCU is committed to building a culture that emphasizes and celebrates diversity. In 2021, TFCU added the Diversity, Equity and Inclusion (DEI) Department to better

Prior to COVID-19, the TFCU Financial Empowerment team only taught in-person financial education workshops. At the height of the pandemic, the talented team proved that

You don’t celebrate your 75th birthday every day. But, when you do, you go big! That’s just what TFCU did in March of 2021, when

Since 2018, TFCU has served Oklahoma’s heroes through its philanthropic entities—the Tinker Federal Credit Union Foundation and Project Oklahoma Heroes. Project Oklahoma Heroes exists to

On September 1, 2021, after 13 years as TFCU’s executive vice president/chief operating officer, Dave Willis took over as TFCU’s new president/chief executive officer. Although

In 2021, TFCU helped introduce a group of six kids, ages 9 to 14, to the excitement of technology and teamwork by sponsoring their participation

Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore.

Tinker Federal Credit Union celebrated a year of strength in 2021, an historic year for this financial institution whose humble roots started with a handful of Tinker Field employees in 1946. Over the next 75 years, TFCU grew to become the premier credit union in Oklahoma and one of the leaders among credit unions nationwide. The strength of TFCU has always been directly tied to the loyalty and trust of our members. As we set a vision for the future, we look to that same loyalty and trust to guide us into the next 75 years.

The year also marked a new era of leadership at TFCU, as we said goodbye to our long-time president and CEO, Michael D. Kloiber, and we ushered in a veteran credit union industry leader, Dave Willis, to the helm. This new direction in leadership will maintain a laser focus on member service, as TFCU always has, while exploring new ways TFCU can bring members the right services to meet their needs in a changing world.

The Board of Directors would be remiss if we did not recognize the extraordinary effort of the TFCU managers and staff who have navigated your cooperative financial institution through the unprecedented obstacles presented as we faced our second year of a global pandemic. This team worked tirelessly to keep our branches and services available to you, even in the face of new and aggressive variants of COVID-19. Hiring shortages and supply chain issues tied to the pandemic were not limited to your local supermarket; TFCU has been managing our way through these challenges, as well.

Additionally, the pandemic left its mark on our members’ financial relationships. Public incentives like the Child Tax Credit provided members with additional income, and TFCU provided a safe place for them to keep it on deposit. Conversely, shortages of automotive microchips created serious supply problems in both the new and used auto markets, driving prices up and limiting availability nationwide. Experts predict we may not see a quick return to the automotive sales ecosystem we are accustomed to from the past.

Even with these challenges, we celebrate a strong ending to 2021, with $5.9 billion in assets and reaching $6.0 billion in March of 2022. More importantly, we celebrate the 438,555 members who have chosen TFCU to provide the financial services to help them achieve their families’ goals and dreams. We look forward to a bright future for TFCU and our members, and we will work tirelessly to ensure another 75 years of prosperity for both.

Sincerely,

Al Rich

Chair, Board of Directors

Al Rich,

Chair

Bill Watkins,

Vice Chair

Gary Wall,

Secretary

Tiffany Broiles,

Treasurer

Eldon Overstreet,

Assistant Secretary I

Rodney Walker,

Assistant Secretary II

Sheila Jones,

Assistant Treasurer

While we celebrate the successes of those who came before us, we now welcome a new management team that is ready and eager to build an even stronger TFCU for tomorrow.

Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore.

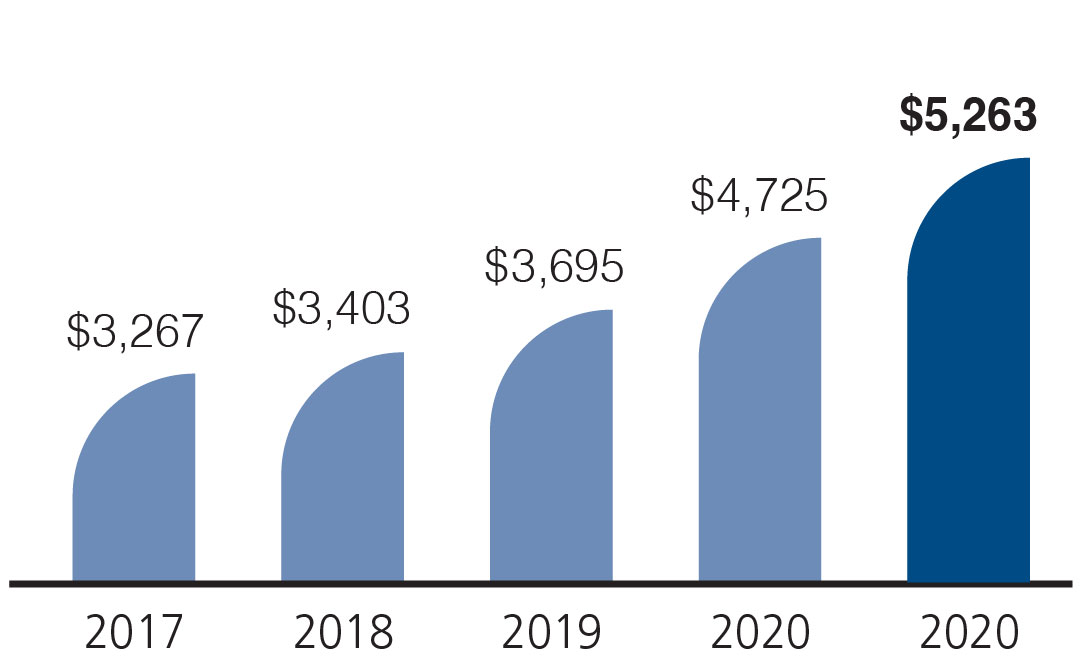

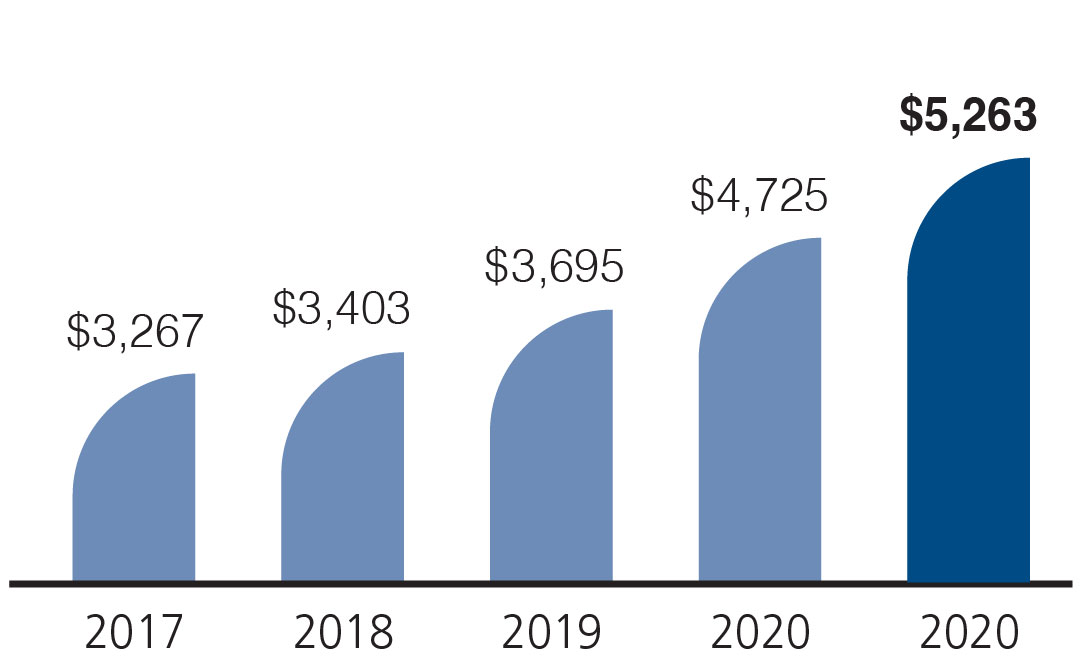

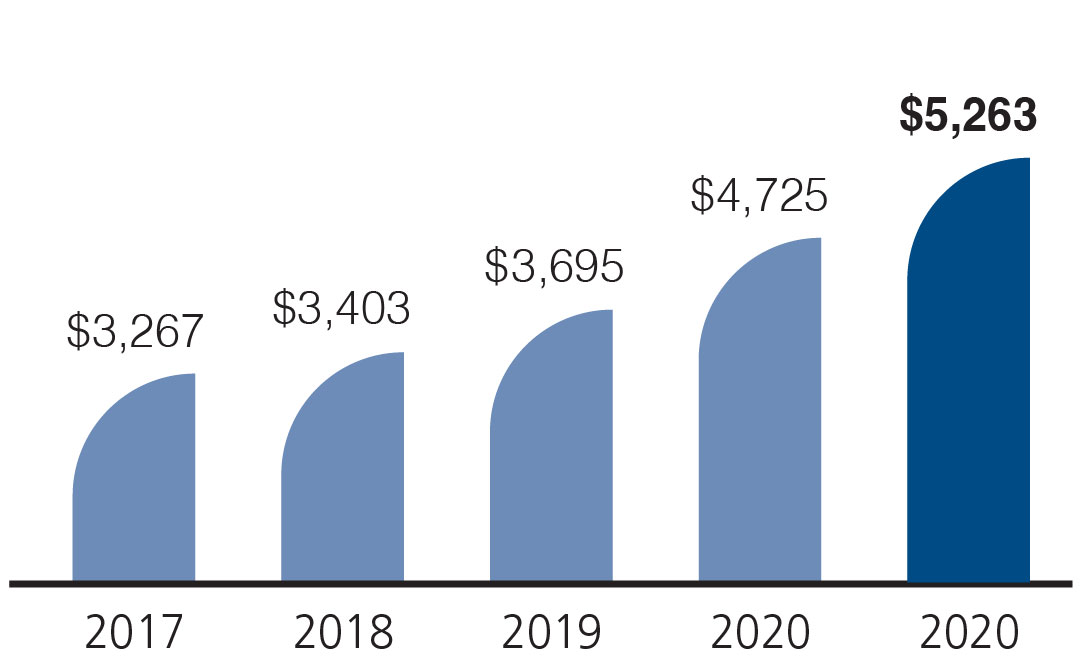

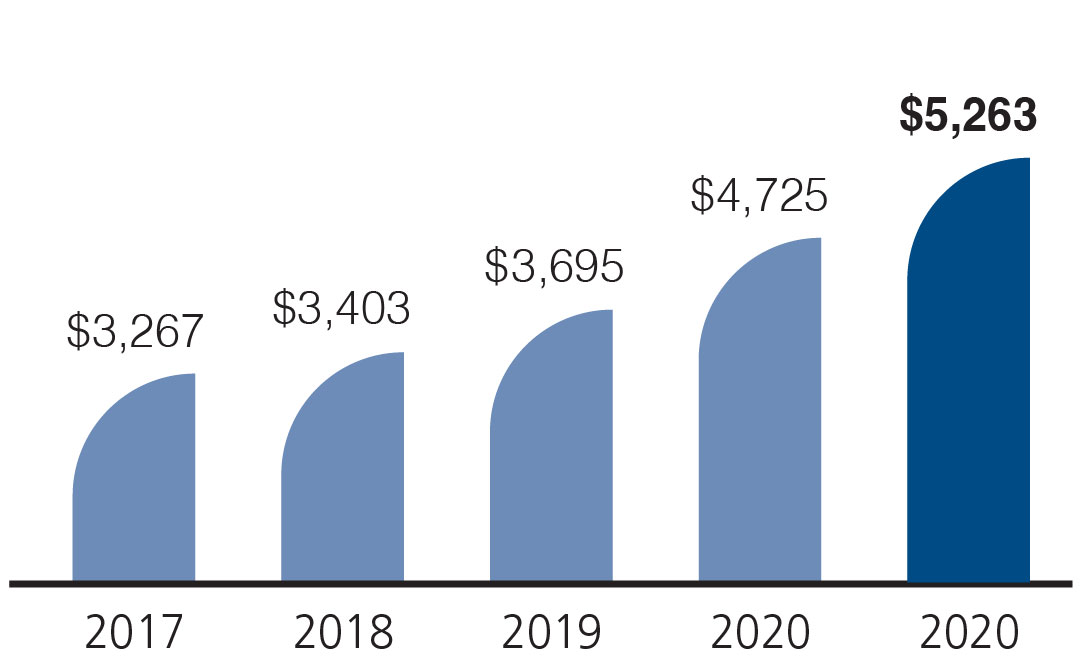

TFCU has kept your money safe and secure for more than 75 years. We continued to do so in 2021, as we all navigated through the second year of the pandemic. We had our second largest annual share growth as members received their second and third round of government stimulus payments. The stock market remained strong throughout the year as the vaccine rollout took place and the travel and service sectors opened back up.

Despite the pandemic and all its challenges, TFCU remained strong. In addition to government stimulus payments and bonus unemployment benefits, the government also approved advance payments for child tax credits. The influx of funds resulted in record share growth, giving us plenty of funds ready to lend.

As the travel industry returns to normal, we’re ready to provide you with your next low rate car, boat or RV loan. TFCU continues to have great loan rates and is ready to make your dreams come true, whether you need a home loan, home equity line of credit, credit card or new vehicle. Since the Federal Reserve Bank is starting to increase rates, do not wait to take advantage of our current low rates. Whether you are borrowing or saving, we’re here to help.

Despite all the challenges the pandemic brought, TFCU ended the year with a Return on Assets (ROA) of 1.26% and a Net Worth of 10.72%. These strong financial results mean TFCU will be the credit union of choice as your children and grandchildren find their own path.

You may wonder why a not-for-profit credit union would need net income. Net income is how we increase our equity, which is our rainy day fund. We encourage you to save money for unexpected emergencies, and we follow that same advice. TFCU sets aside funds (net income) into our rainy day account (equity) every year. This practice keeps us strong to best serve you no matter what path the economy may take.

It is our honor to help you achieve your goals and realize your dreams.

Respectfully,

Tiffany Broiles

Treasurer, Board of Directors

Millions

Millions

Millions

Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore.

The Supervisory Committee is responsible for evaluating the safety and soundness of Tinker Federal Credit Union’s operations. Overseeing internal and external reviews of accounting records, internal controls and procedures ensures TFCU accomplishes the duties outlined in its charter. To help with this process, the committee engaged the services of Doeren Mayhew, a certified public accounting firm, to administer external reviews of control and financial procedures. The firm established that TFCU’s financial statements are in compliance with generally accepted accounting principles.

The committee takes pride in assuring the continued integrity of TFCU for the membership. TFCU remains strong due to the quality of our members, management, staff and volunteers. We look forward to another year of strength and stability for TFCU.

Sincerely,

James Pearl

Chair, Supervisory Committee

James Pearl,

Chair

Scott Freeman

Scott White